Social Media Product Analysis for Earnings Surprises

It has historically been extremely difficult for analysts and investors to bring a significant edge to earnings releases. After all, there are regulations around preventing investors from gaining any significant advantage from management. So, how can an investor gain such an edge?

The analysis of alternative data can offer some interesting insights, and in some cases offer a significant edge, to investors before an earnings release. To be successful, investors must first identify a key variable or one that could result in a major change for the company or sector and then use alternative data to provide an insight that the market is somehow overlooking.

Now, this is a fairly broad mandate. You can apply this approach in many different ways and environments. To better understand this concept, we should go over an example.

Watch Industry

The global watch industry is nicely set up for this type of analysis as recent assumptions surrounding sector dynamics appear fairly one-sided. After the introduction of Apple’s watch and the entrance of Samsung into the space, the default assumption was that everyday non-luxury watches would quickly be dominated by these two tech giants. Additionally, less expensive Asian brands would gobble up the lower end of the market. This left Fossil and Fitbit to languish in the middle – they were not big or tech-savvy enough to compete with Apple and Samsung, and their cost structures were too high to compete in the lower end market.

This inevitable operational squeeze for these once high-flying companies resulted in crashing stock prices. Fossil (FOSL), for instance, fell from $139 in 2012 to $5 near the end of 2017. With hindsight, we can see how rumors of Apple’s watch marked FOSL peak, while its true stock collapse really hit its stride as Apple announced (2014) and released (2015) its watch. Fitbit (FIT) followed a similar path with a high of $51 in 2015 and hit just under $5 in early February 2018. If FIT would have been listed earlier instead of in 2015, its decline would have likely been more severe.

For FIT and FOSL, the entrance of these tech giants into the watch industry has been highly destructive. Their stocks fell by over 90% in just a handful of years. Furthermore, these stocks did not decline due to a recession or even problems in the growth of the sector, but by the assumption that they would eventually be pushed out of business and/or that they simply could not compete in the sector’s new environment.

Key Variable

For FIT and FOSL the key variable is revenue, which could signal stabilization of expectations against Apple and Samsung if shown to outperform market expectations. In other words, the negative operational expectations for FIT and FOSL need to come back to neutral. Having been negative for so long and working off of such a low stock price base, these bombed out stocks could really jump if expectations simply go back to neutral.

We decided to focus our analysis on Christmas sales. Like many other consumer-linked companies, a significant portion of annual revenue is booked during the 4Q due to the Holiday Season. An investor who could better determine such sales could get a significant advantage or edge before the earnings release. To be clear, seasonal companies, dependent on a particular quarter for instance, will provide important insights into that quarter during its follow-on earnings release. Such an earnings release could make or break an entire year.

In the case of the watch industry, our assumption is that positive or even neutral interpretation of the earnings release for FOSL and FIT would result in out-sized stock impact.

Setting Up the Study

Our focus is firmly around trying to determine potential sales of the main products of each company. If the main products of FIT and FOSL, or the companies depending on the data source, do not show significant signs of life, then we assume the current trend will continue. If, however, there are positive signals, this could be enough to provide the edge we are looking for prior to the earnings releases.

The products include:

- Apple: Apple watch, series1, series2, series3, and various mutations of these terms,

- Samsung: Samsung watch, gearS2, gearS3, gearsport, and various mutations of these terms,

- Fitbit: Fitbit, ionic, blaze, charge, charge2, alta, and various mutations of these terms,

- Fossil: Fossil Q, Q gen2, Q gen3, explorist, marshal, wander, tailor, Michael Kors watch, various mutations of these terms and other watches related to Fossil and brands outsourcing production to Fossil.

Data sources include Twitter, Facebook, Youtube, Amazon, and BestBuy.

Our approach was to analyze data during 4Q17 and 1Q18 in order to determine changes in trends around presumed peak sales events.

As a side note, we analyzed other products and companies as well but concluded they were not worth including. For instance, Garmin has a solid watch offering but it targets a niche of the market and is currently not viewed as a direct competitor or as a factor that would push FIT or FOSL out of business. We also looked at some of the smaller Asian competitors but disregarded them due to low price-points. Additionally, after collecting and analyzing the data of luxury watch makers like Omega, Rolex, and Bulgari, we disregarded them for this study as well as they focus on a different niche.

Preferred Data Source for this Study

As with most alternative data analysis, some human curation is necessary. This is especially true for determining which data sources and trends make the most sense for analysis.

For instance, we noted that Fossil’s data from the distribution channels of Amazon and Best Buy were rather low and inconsistent which likely was due to Fossil having a significant brick-and-mortar sales presence – distorting this data for Fossil. For comparing across the four main companies, we decided to take these data sources out.

We had high expectations for analysis of tweets, especially of hashtag analysis on Christmas. The basic idea was to look for spikes in product hashtag usage as people mentioned the presents they received. Surprisingly, such spikes occurred but were spotty, making this source difficult for a broader analysis. Similar observations can be made for Facebook data.

Youtube ended up being our preferred source of data for the study. We had focused on analyzing the number of views of videos focusing on product reviews and ‘how to’ use / set up the watches. People would likely go to Youtube and watch a video(s) on the watch they received as a present and/or bought. In theory, there would be spikes for all the main products on Christmas and perhaps right after. Essentially, this is what we witnessed in that surges occurred in the absolute number of views for each of the products which provides interesting insights into revenue trends for the companies.

Youtube View Trends

In the case of Youtube video trends, we can highlight interesting insights but should warn you that much depends on videos chosen for analysis. For instance, though the analysis is based on the trends observed, these trends are dependent on which videos are included. There are many potential pitfalls in alternative data analysis and the choice of data (such as which videos to include) and the data source (such as Youtube) often depends on human choice. Having given this mini-disclaimer, the trends appear fairly obvious.

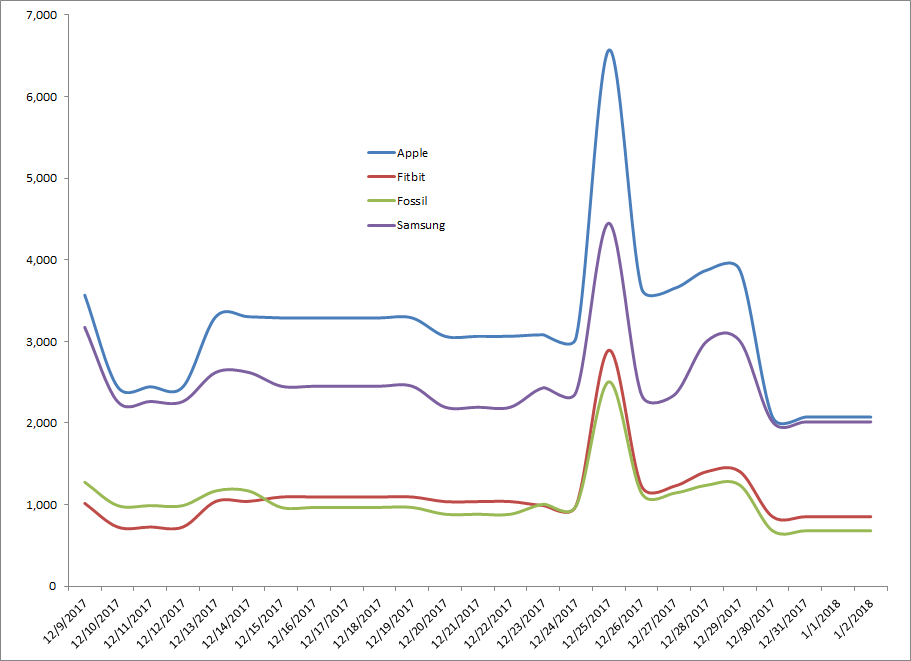

Exhibit 1: Average number of Daily Youtube Video Views of Five Primary Product Videos for Apple Watch, Samsung Watch, Fitbit, and Fossil Q Series Watch

Source: Youtube and ZettaCap Note: Data is smoothed and de-trended

As you can see, there were spikes of number of views around Christmas and smaller ones soon afterwards for all of the data series analyzed. This is not really surprising as we would expect there to be a rush to view product videos right after people received those products as presents. The previous chart is important to include as it shows that the data passes the common sense test. The following chart provides more of an insight into relative results of the products.

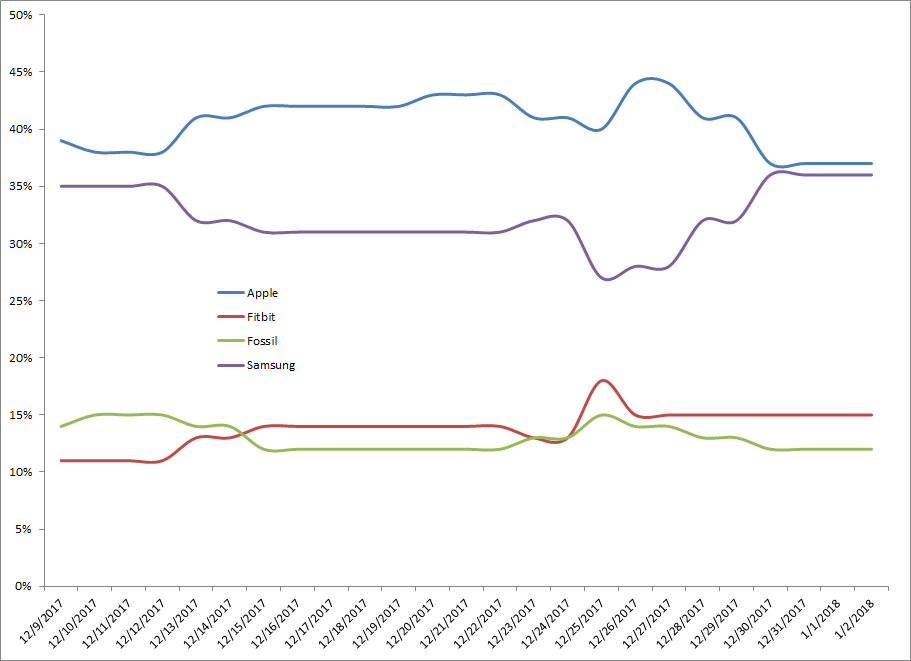

Exhibit 2: Relative Percentage Views of Daily Youtube Video Views of Five Primary Product Videos for Apple Watch, Samsung Watch, Fitbit, and Fossil Q Series Watch

Source: Youtube and ZettaCap Note: Data is smoothed and de-trended

As you can see, both Fitbit and Fossil have small upward spikes around Christmas, while Samsung losses significant ground and Apple dips on Christmas but bounces afterwards.

Essentially, the previous chart shows market share of views. As both Fitbit and Fossil move slightly higher during the peak present exchange of the year, we can infer that their products also slightly outperformed the dominant players in relative terms during this key period.

So, why would ‘slightly’ be so important? Why even highlight such a meager trend?

Well, under normal circumstances, such slight outperformance would not amount to much. In fact, the higher absolute trends for Apple and Samsung would likely be highlighted instead. But, the current market conditions assume that Fitbit and Fossil are goners – that they simply cannot compete and that it is just a matter of time before they either get bought or go bankrupt. Furthermore, a soft 4Q and/or Holiday Season for these companies would have likely signaled acceleration for their demise. In contrast, evidence, even meager evidence, of an uptick in demand or of these companies’ ability to compete would be greeted with jubilation.

Fossil has already released its results for the 4Q17, which were on the upper end of market expectations and showed that the company’s focus on smartwatches has been productive. Even with year-on-year revenue declining, its outlook did not seem to be of a company going towards bankruptcy but of one pulling itself out of a difficult period. Fossil’s line of Q series watches was actually able to compete against Apple and Samsung which provided a renewed and positive outlook for the company. The key point here is that the results were not stellar but they pointed towards stability and highlighted the company’s watch division’s ability to compete.

Following FOSL’s earning release, its stock price appreciated 99% from the previous day’s close to that day’s high. That’s right, the expectations were so negative for the company, that it reporting results showing a slightly improved outlook, as opposed to the assumed destruction due to Apple and Samsung, was enough for the price of the stock to go up by 99%. Alternative data clearly provided insights that FOSL’s results would not spell disaster – in fact, they showed that in relative terms, Fossil’s Q series did reasonably well during Christmas.

For Fitbit, very similar insights can be made. Though the market does not appear to be as negative on Fitbit as it was on Fossil, it still appears as if a sign-of-life earnings release will be greeted with considerable relief in the market. That is, relief that the company is not on its way to bankruptcy or some market-exit strategy. Again, the evidence is slight. We did not see Fitbit or its products dominating in our analysis. However, they did extremely well in comparison to the apparent poor expectations set out by the market.

In addition to the Youtube data, other data showed strong performance for Fitbit around Christmas. For instance, the volume of its twitter hashtags compared favorably to those of Apple watch (using the many mutations of the names of each company’s product-lines) – on some days even beating Apple. And, when looking at Facebook likes, Fitbit was one of the few consumer based companies / products to move higher on Christmas and soon afterwards, implying that it could have outperformed as a present in comparison to other similar consumer products. In terms of potential sales of units, Fitbit products performed very well on Best Buy in comparison to the sector’s leader, Apple. The daily number of reviews of its products exceeded those of Apple on Christmas and more or less matched them in the week that followed – implying unusually strong relative sales for this holiday.

Under ‘normal’ market conditions, perhaps such data would not be of any significant interest. But, recall that FIT, like FOSL, has suffered during the previous few years. It is currently trading at $5.4 from its $51 high. Good news, any good news, relating to its ability to compete with Apple and Samsung will likely have an outsized positive impact on its price. As risk / reward goes, it seems like a good time to revisit FIT.

As a disclaimer, be advised that alternative data analysis for stock picking and/or investment research is still a relatively new technique and that you should conduct your own investment research before investing.