2017 Dutch Election ‘Unexpected’ Outperformance by Left-Leaning Parties

The Netherlands holds its next general election on March 15, 2017, or one week from today. Most expect parties on the right of the political spectrum to do well – that is they are expected to dominate according to pundits, polls and betting markets.

Social Media Influence (SMI) ratings, however, point towards left-leaning parties as the big winners. The importance of the Dutch Election cannot be underestimated in the current global political environment as it comes before elections in France and Germany and should to a significant extent set the tone for Europe in 2017. Unexpected outperformance by left-leaning parties in the Netherlands will influence elections in these two larger countries and help to determine Europe’s future.

The main conclusions of our SMI analysis, which will be covered throughout this post, are that D66 and GL (two left-leaning parties) will do much better than expected and PVV and VVD (two right-leaning parties) will perform much worse. The implication is that the Netherlands will, post-election, become more pro-Euro and pro-immigration than it is currently and certainly more so than most assumed.

Betting markets, polls, and pundits have focused on two parties, the PVV and VVD. The PVV is the populist right-wing party led by charismatic leader Geert Wilders. His party usually leads in the polls and, as the primary populist party, has received more than its fair share of media attention given the presumed global trend towards populism. The VVD, a center-right party, received the most votes in the last election, its party leader is the country’s prime minister, and at times leads in the polls, barely nudging out the PVV for poll leadership. These two parties are the consensus favorites to come in first and second place — the only real question remaining for most is which party will be first and which second.

Having the PVV and VVD as the principal winners of the election would drag the Netherlands further to the right. In fact, the majority of forecasts state that the PVV will gain the most from the election and that there is a real risk of the PVV’s anti-immigrant and Eurosceptic policies being incorporated into Dutch policy.

The betting markets are more or less declaring that these two parties will clean up at the election. PredictIt creates a market to bet on which party will win the most house seats in the upcoming Dutch Election – higher prices imply higher probability. Current prices include PVV at 55, VVD at 40, CDA (right-leaning) at 5, and all other parties at 1 or a market is not made as the chances are inferred to be too low to include. Basically, the betting markets state that outside of the top two parties, the chances are extraordinarily low.

In contrast to more traditional analytical tools, the SMI looks at what people are doing on-line on social media and measures influence of candidates and parties. A higher level of influence on social media equates to more implied support whereas a lower level of influence means less support. In a normal situation, poll figures and SMI ratings would more or less place support around the same level.

However, at present the global political environment is one of volatility and contention. The result is that many of the traditional data and forecasting tools, which were created and tested in more stable and less biased conditions, have stopped being as accurate as in the past. SMI analysis, being much less open to bias, has tended to provide better insights in this somewhat unchartered electoral territory.

The SMI paints a much different picture of the upcoming Dutch Election. It shows the PVV and VVD, as well as other right-leaning parties, underperforming their poll figures and left-leaning parties outperforming their poll figures.

Before getting further into forecasts, we should go over the Dutch political environment. It seems to be much more volatile than most. Unlike in other countries like the US, UK or Germany, the current dominant political parties are rather new in the Netherlands. The VVD, though being the lead member in the current government, won its first national election in 2010 though having been founded in 1948. The PVV was founded in 2006 and has never gained more than 20% of the national vote. In short, the two parties, which are apparently dominant in the current election according to the consensus, do not have very long track-records of success.

Also, it should be highlighted that placing political parties neatly on a left-right spectrum is always handy, but not always practical. In the Netherlands, it becomes more complicated due to the high number (28) of parties registered for the March election. Of these, there are multiple, that would seem more like interest groups in the US, which might use membership to lobby the government or lobby political parties, but not form their own party. One example is the 50Plus Party, which advocates for issues of pensioner, and another is the PvdD, which advocates for animal welfare. Additionally, some parties tend to be very centrist which makes a left-right paradigm somewhat difficult.

So, the Netherlands is not your average political environment. With so many parties, some of which being extremely focused on interest-group level topics, and with the poll-leading parties not having very long track-records, the environment appears inherently volatile, without even considering the volatility of global politics at present.

With these basic disclaimers in mind, we compare poll figures for the leading parties to their respective SMI ratings.

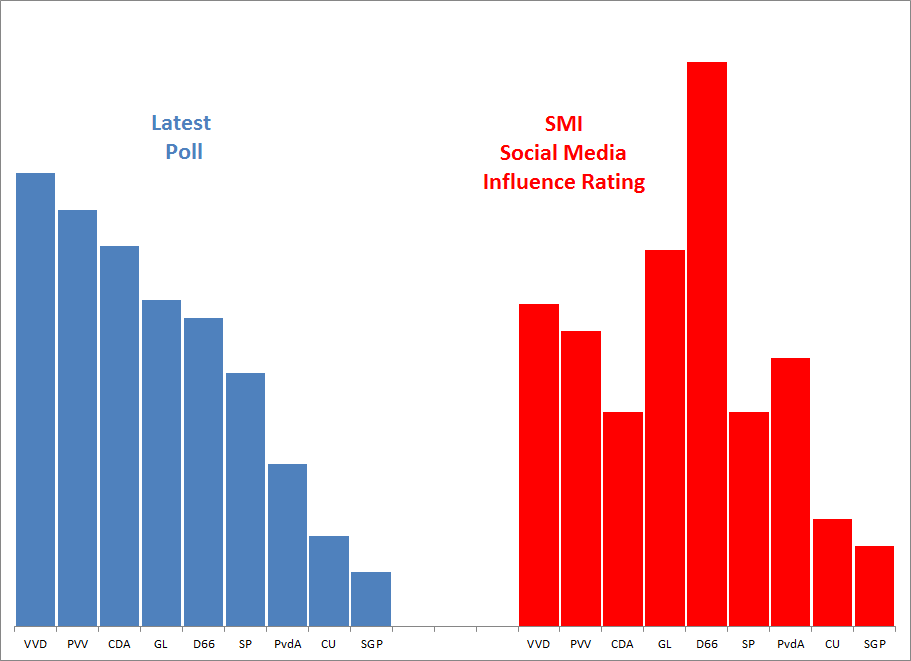

Chart 1: 2017 Dutch General Election, Comparing Poll Figures to Social Media Influence (SMI) Ratings, in order of poll data

Source: ZettaCap and Peil, note that in the Netherlands most polls show the number of seats and not percent vote

General patterns appear more obvious once we split the above chart into left-leaning and right-leaning groups. On the ‘left’, we’ve included D66, GL, PvdA, and SP and on the ‘right’, PVV, VVD, CDA, CU, and SGP. Polls forecast that these two general groups will receive about 90% of the seats.

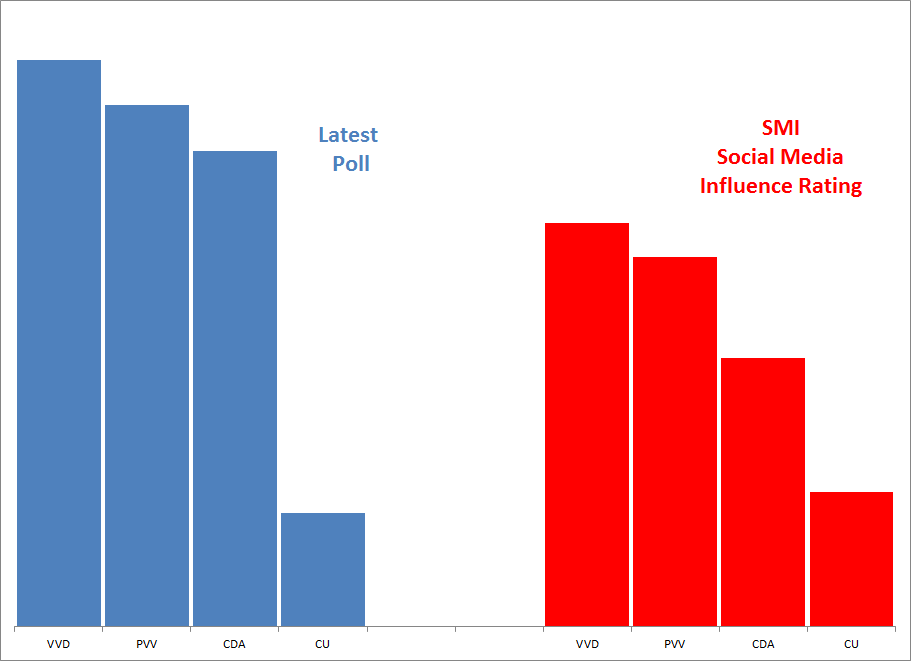

Chart 2: 2017 Dutch General Election, Comparing Poll Figures to Social Media Influence (SMI) Ratings for Right-Leaning Parties

Source: ZettaCap and Peil, note that in the Netherlands most polls show the number of seats and not percent vote

For parties on the right, the general theme is forecasted underperformance in relation to polls given their relatively weak SMI ratings. The PVV, or the populist party expected by many polls and the betting markets to win the most seats, is shown to have a surprisingly low SMI. The VVD, which polls around the PVV, has a similarly weak SMI as compared to its strong poll figures. In other words, SMI ratings imply that the PVV and VVD will underperform their poll figures to a significant degree. This could be one of the largest surprises in the 2017 Dutch General Election in that the PVV has been aggressively covered by the media and painted by commentators as more or less a shoe-in for winning the most seats.

The CDA has the worst ratio of SMI to poll figures. The CDA had been the dominant force in Dutch politics until this decade. From the late 1970s to the beginning of the 2010s, it was in the ruling coalition and normally as the lead party having won the most seats. In the last few elections it has consistently slipped. Assuming the SMI is correct in forecasting large underperformance, the once dominant CDA would become a second-tier party.

Left-leaning parties, in contrast, have relatively strong SMIs implying that they will perform much better than current polls suggest on election-day.

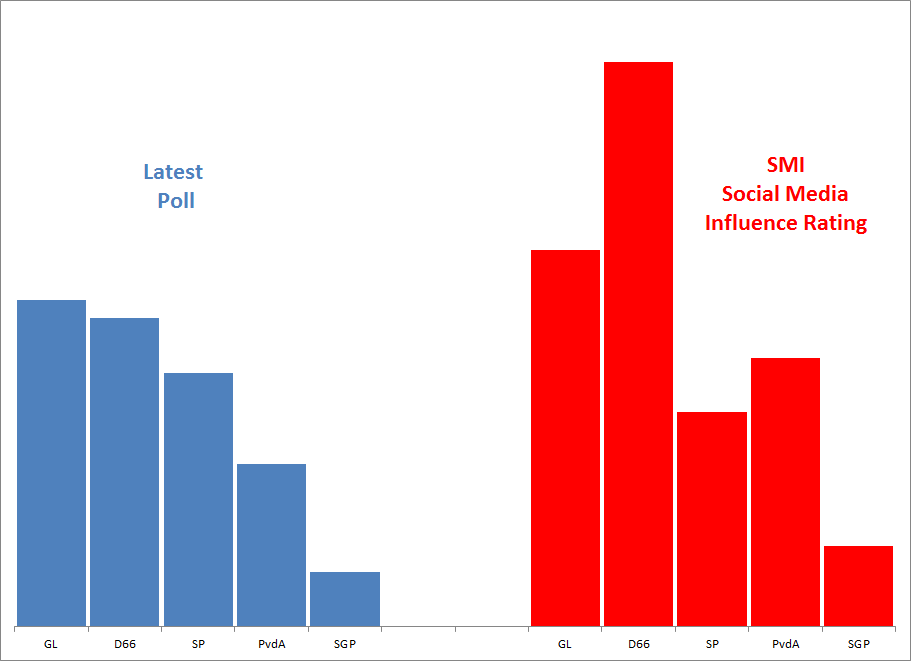

Chart 3: 2017 Dutch General Election, Comparing Poll Figures to Social Media Influence (SMI) Ratings for Left-Leaning Parties

Source: ZettaCap and Peil, note that in the Netherlands most polls show the number of seats and not percent vote

Some clarification should be provided for D66. It is classified here as a left-leaning party. In reality, it is mostly a centrist party that has worked successfully with parties on the left and right. However, it seems like one of the main reasons its SMI has strengthened beyond its poll figures is that it has butted heads repeatedly with the PVV, or the populist party. In a sense, many who do not like the PVV or its leader Wilders look to D66 as a counter-weight. In a different environment, D66 could be categorized more in the center but due to its anti-PVV stance, it is seen in the current election as more left-leaning.

The other main left-leaning party that greatly outperforms its polls is the GL, or the Green Party. Its SMI has actually gained a significant amount of traction recently due to its most visible elected official, Jesse Klaver, who is part Moroccan. For those not following the election, Wilders of the PVV has attacked Moroccan immigrants making support for Klaver a type of anti-PVV stance.

The big questions currently as it relates to SMI analysis of the Dutch Election include:

- To what extent are left-leaning parties like D66 and GL benefiting as the perceived anti-PVV parties?

- Will this translate into votes or simply a social media boost?

Currently, we take SMI ratings at face value and assume higher SMI ratings will translate into votes. In this case, D66 and GL should greatly outperform their poll figures, with D66 winning the most seats.

Other recent political campaigns have included candidates who many disliked with a passion. Examples are clearly present in the US and France. Regardless, however, SMI ratings appear to have been most accurate when making forecasts (note that the French election has yet to occur but judging from its current interpretation, we believe this to be the case in France). In other words, if they did not significantly distort forecasts in the US and France, it does not seem likely for the Netherlands.

The main reason for pause is not recent SMI performance in other elections or our confidence in SMI analysis, but the current betting market data. We do not include data or observations from betting markets, polls or pundits into the SMI calculations. And, there have been cases where SMI forecasts have greatly diverged from consensus views. However, in the case of the Dutch Election, the SMI forecasts appear highly unusual in comparison to betting markets.

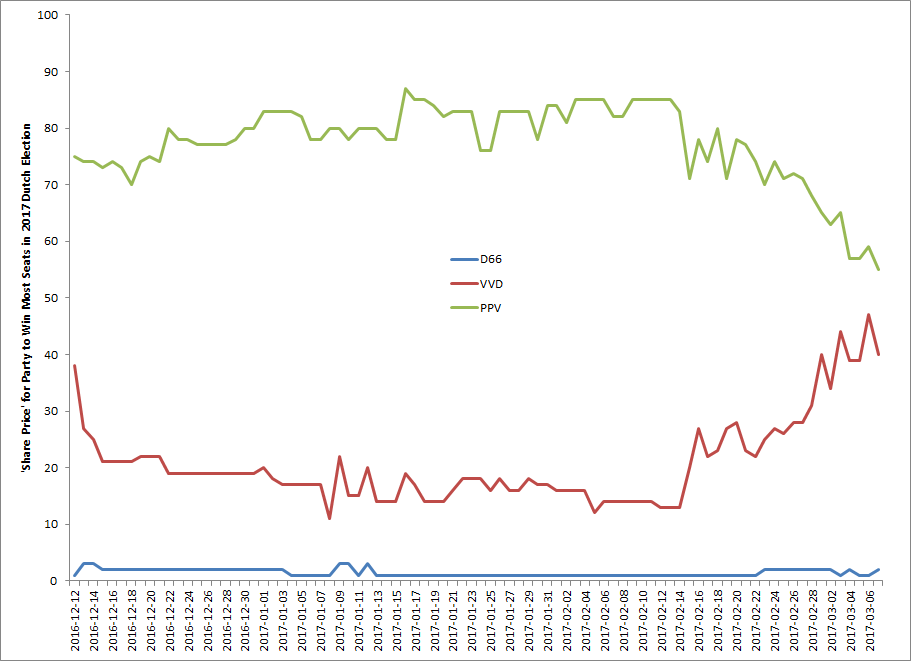

Chart 4: PredictIt Betting Market ‘Share Price’ for PVV, VVD, and D66, for which party will win most seats in 2017 Dutch Election

Source: PredictIt

D66’s ‘share price’ has not gone above 3, which equates to a 3% chance of it winning the most seats in the election. Furthermore, GL, the other main left-leaning party identified by SMI as likely to significantly outperform its poll figures, does not even have a betting contract on PredictIt, apparently due to low interest. In other words, the general betting markets appear to have a very high level of confidence that either PVV or VVD will win the election. In fact, the average over the last month that either PVV or VVD will win is 99% — so definitively the markets do not believe that D66 winning is anything remotely close to possible.

This is no trivial matter. Betting or prediction markets have been praised as a viable way to predict a future event by harnessing the collective knowledge of market players. Betting markets, however, did not perform very well during the Brexit or US Presidential Election votes. If they fail to such a significant extent in the Dutch Election, a major re-write may be necessary – not so much in how these markets work but of the validity of the data that market participants use to quantify their bets. This is a much larger topic than can be presented in one post, but essentially if D66 and/or GL either win the most seats or significantly outperform polls, many will once again question the validity of political pundits and polls.