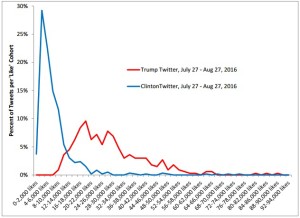

Research focusing on forecasting 2016 US Presidential Election using Social Media and Wikipedia data. Shows that Trump performs extremely well on modern on-line metrics. Forecast is for a Trump general election victory based on these metrics.

ZettaCap Election Research_August_2016

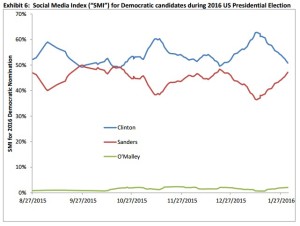

Research using Social Media Influence (SMI) Index to analyze Democratic and Republican Nominations. Before primary voting began, the SMI forecast a very tight race between Clinton and Sanders with Clinton eventually winning and Trump winning a decisive victory on the Republican side. In comparison to pundit analysis, the SMI called the nomination process exceptionally early and well.

ZettaCap Election Research_February_2016

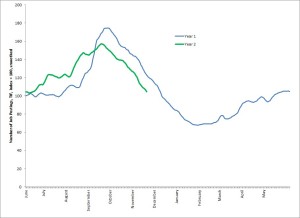

ZettaCap Research showing the usage of on-line Job Postings to analyze company performance. This report shows forecast weakness in Tiffany Co. (TIF) stock due to deteriorating hiring at the company prior to peak end-of-year holiday season. Within a month of this report the company downgraded its guidance due to lower than expected demand producing a one-day decline of +10%, confirming the predictive power of on-line postings for fundamental equity analysis.

ZettaCap Research_Job Postings_TIF

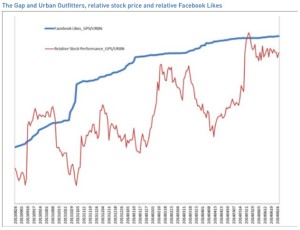

ZettaCap research showcasing Stock Price Extraction from social media and its ability to help to determine stock prices. By identifying stock prices mentioned within communications like tweets and comparing them to actual stock prices, an improved version of sentiment is created. This method is shown to have provided early signals of major inversions for major stocks, commodities and currencies.

ZettaCap Research_Stock Price Extraction Sentiment

ZettaCap research highlighting usage of Facebook Likes, Job Postings, and social media derived sentiment to improve stock timing and selection. Such data can help for both technical and fundamental analysis of stocks.

ZettaCap Research on Alternative Data for Stock Analysis

Presentation for Socionomics Conference. Shows the Mood Index which uses text analytics on global financially related communications to determine the direction of the global equity cycle. Inversion of Mood Index in Feb 2012 forecast major global equity rally.

Amalgamood Socionomics Presentation

Presentation for Text Analytics West Conference. Highlights the Mood Index which was to my knowledge the first global index based exclusively on text analysis used to forecast the global equity cycle. The Mood Index correctly called the peak of the global equity cycle in 2007 and its low in 2009.

AmalgaMood Mood Index Presentation